Corporate Profile

EQT Corporation (NYSE: EQT) is an independent natural gas production company with operations focused in the Appalachian Basin, one of the lowest carbon-intensive and methane-intensive basins in the United States. We are dedicated to responsibly developing our world‑class asset base and being the operator of choice for our stakeholders. We prioritize operational efficiency, technology, and sustainability and look to continuously improve the way we produce natural gas, a lower-carbon, reliable, and low-cost energy source. We have a longstanding commitment to the safety of our employees, contractors, and communities and to the reduction of our overall environmental footprint. Our values — Trust, Teamwork, Heart, and Evolution — are evident in the way we operate and in how we interact with our stakeholders each day.

Our mission is to realize the full potential of EQT to become the operator of choice for all our stakeholders.

As one of the largest producers of natural gas in the United States, we are responsible for producing the equivalent of over 1 minute of every hour of electricity consumed in the United States. We are dedicated to evolving energy and enhancing the critical role that natural gas plays in the future energy mix, both domestically and abroad.

We aim to maximize the value derived from our assets while we minimize the impact of our operations on the environment via technological innovation. We strive to improve the way we work, maintain a rewarding and collaborative workplace, and actively engage with our landowners and the communities where we operate and where our employees live and work. Furthermore, we aim to test the boundaries of what is possible in operational performance and leverage technological and human capital to execute our combo-development strategy — leading to a step-change in operational efficiency.

In 2023, we produced over 2,000 billion cubic feet of natural gas equivalent (Bcfe) in gross hydrocarbon production.[1] As of December 31, 2023, we had 27.6 trillion cubic feet of natural gas equivalent of proved natural gas, natural gas liquids (NGLs), and crude oil reserves across approximately 2.1 million gross acres. Approximately 99% of our gross production is natural gas and NGLs. With 881 employees as of December 31, 2023, we generated approximately $6.9 billion in total operating revenues in 2023.

We have historically pursued and will continue to explore, opportunities to create value through strategic transactions whether through mergers and acquisitions, divestitures, joint ventures, or similar business transactions.

In 2021, we acquired assets located in the Appalachian Basin (Alta Assets) from Alta Resources Development, LLC (Alta). Data from the Alta Assets is included in this report; however, production and sales volumes and emissions data related to the Alta Assets have been disclosed separately from our 2021, 2022, and 2023 data to track our progress against our 2025 emissions targets.

Additionally, in August 2023, we acquired THQ Appalachia I Midco, LLC (Tug Hill) and THQ-XcL Holdings I Midco, LLC (XcL Midstream). Tug Hill’s upstream assets (the Tug Hill Assets) produce approximately 800 million cubic feet of natural gas equivalent (MMcfe) per day with a 20% liquids yield. XcL Midstream’s gathering and processing assets (the XcL Assets, and together with the Tug Hill Assets, the Tug-XcL Assets) add 145 miles of owned and operated midstream gathering systems to our operations, which connect to every major long-haul interstate pipeline in southwest Appalachia. Data from the Tug-XcL Assets is included in this report; however, production and sales volumes and emissions data related to these assets has been disclosed separately from our historical data.

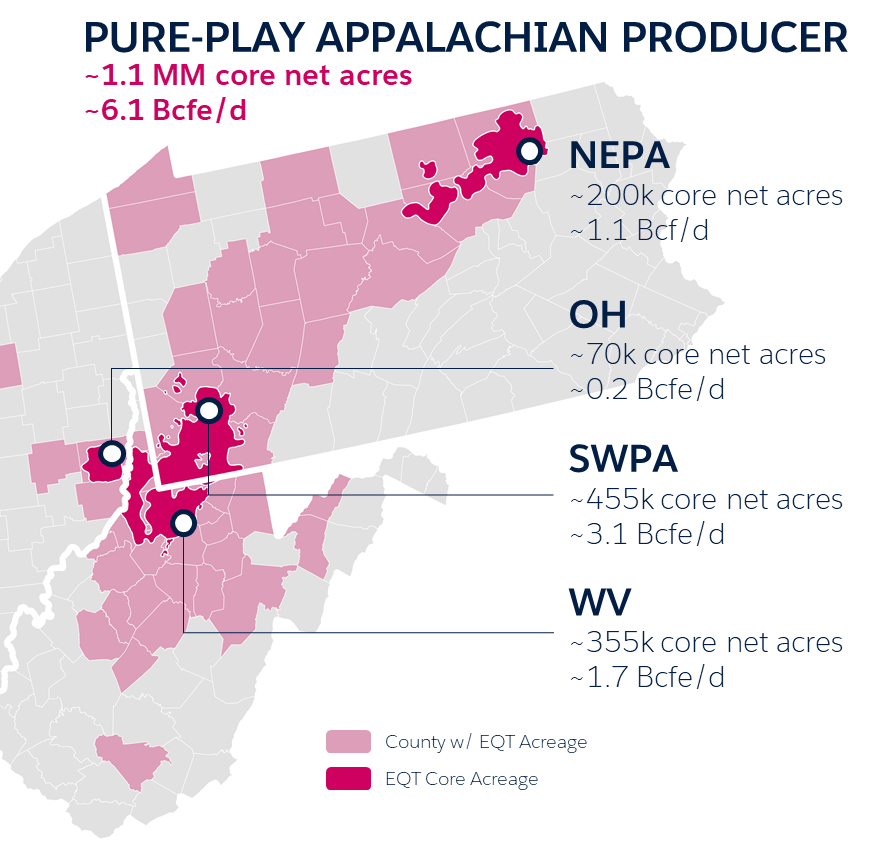

Our operations span Northeastern Pennsylvania (NEPA), Ohio (OH), Southwestern Pennsylvania (SWPA), and West Virgina (WV). See the illustration below for a map[2] of our primary production area.

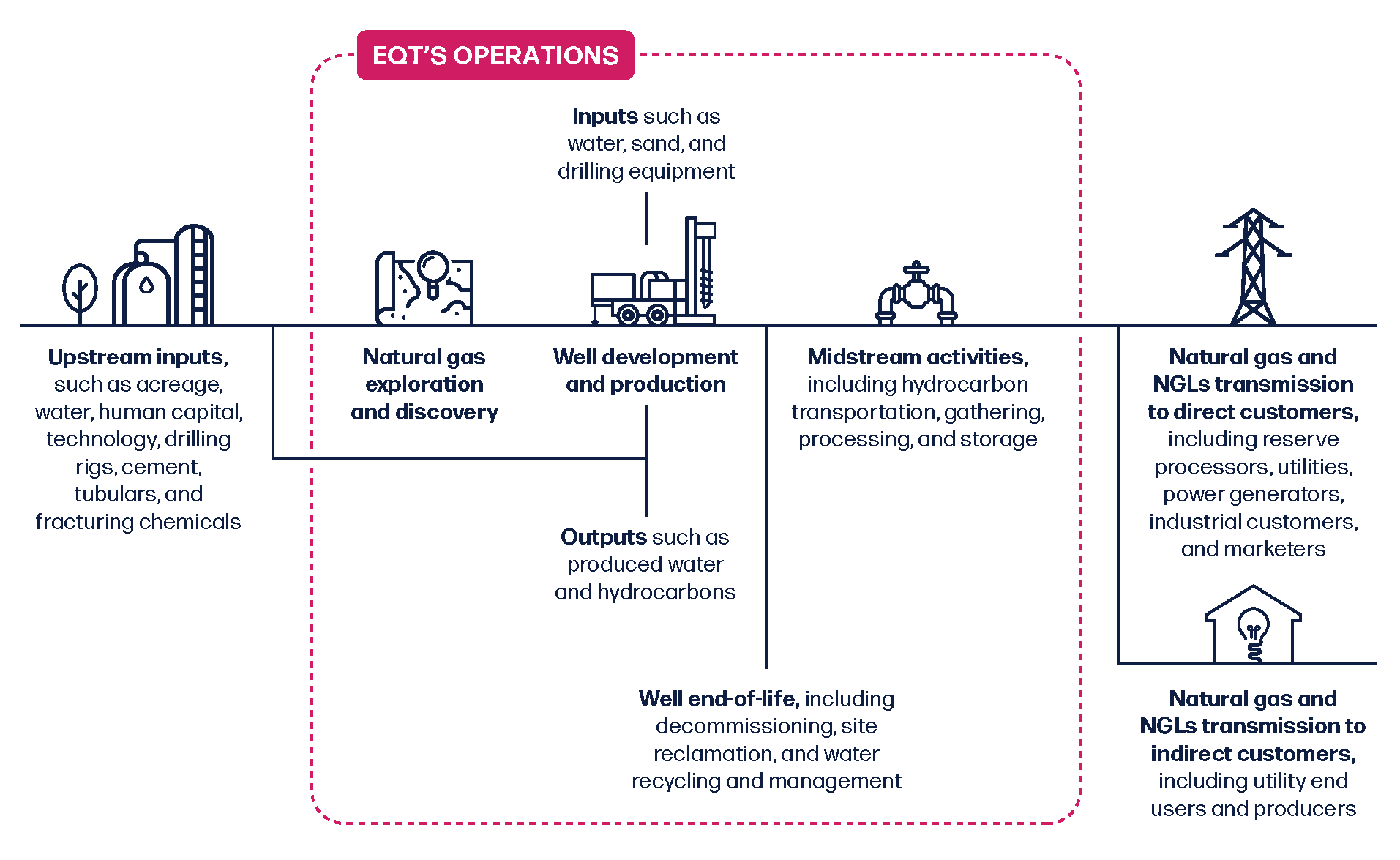

The natural gas supply chain, from discovery to market delivery, is a complex series of activities. For end users to receive natural gas or natural gas-derived products, we must first find and produce the resource. We have investments within the discovery and production phase of the value chain — including drilling, completion, pumping, and gas field service providers, casings for drilling, and information technology products. In 2023, we further expanded our midstream activities as a result of our acquisition of Tug Hill and XcL Midstream.

We produce natural gas, and to a lesser extent, NGLs sold as a commodity to marketers, utilities, power generators, and industrial customers in the Appalachian Basin and in other demand regions accessible through our current transportation portfolio. Our transportation portfolio includes access to demand in the Gulf Coast, Midwest, and Northeast United States, and in Canada. As of December 31, 2023, approximately 43% of our sales volume is sold outside Appalachia. We also contract with certain processors to market a portion of our NGLs on our behalf.

Our value chain is illustrated below.

Unless otherwise noted, all references to “EQT,” “we,” “our,” or “us” in this report refer collectively to EQT Corporation and its wholly-owned subsidiaries.

Reserves and Production

The table below shows our annual gross production using various standard industry denominations[3] to measure volumes of natural gas, oil/condensate, and NGLs.

Gross Production[4]

|

| 2018 | 2019 | 2020 | 2021 (EQT) | 2021 | 2022 (EQT) | 2022 | 2023 (EQT) | 2023 (Alta Assets) | 2023 (Tug-XcL Assets)[5] |

|---|---|---|---|---|---|---|---|---|---|---|

| Natural Gas | ||||||||||

| Bcfe | 1,739 | 1,802 | 1,919 | 1,942 | 222 | 1,834 | 192 | 1,791 | 189 | 276 |

| MBOE | 289,814 | 300,293 | 319,821 | 323,750 | 37,064 | 305,683 | 31,967 | 298,526 | 31,480 | 46,045 |

| MMcf | 1,738,883 | 1,801,755 | 1,918,923 | 1,942,499 | 222,384 | 1,834,098 | 191,804 | 1,791,157 | 188,882 | 276,269 |

| Oil/Condensate | ||||||||||

| Bcfe | 4 | 5 | 19 | 21 | 0 | 14 | 0 | 14 | 0 | 19 |

| MBOE | 680 | 820 | 3,199 | 3,542 | 0 | 2,250 | 0 | 2,263 | 0 | 3,088 |

| Mbbl | 680 | 820 | 3,199 | 3,542 | 0 | 2,250 | 0 | 2,263 | 0 | 3,088 |

| Total Gross Production | ||||||||||

| Bcfe | 1,743 | 1,807 | 1,938 | 1,964 | 222 | 1,848 | 192 | 1,805 | 189 | 295 |

| MBOE | 290,494 | 301,113 | 323,020 | 327,292 | 37,064 | 307,933 | 31,967 | 300,789 | 31,480 | 49,133 |

In 2023, our daily gross production averages[6] (including production from the Alta Assets and the Tug-XcL Assets) were as follows:

- Natural gas: 6,182 MMcf per day

- Oil/Condensate: 15 thousand barrels of oil (Mbbl) per day

For more information regarding our reserves and productive and in-process wells see our 2023 Form 10-K and 2024 Proxy Statement.

Technological Innovation

Our use of technology and commitment to process improvement play critical roles in worker safety, community well-being, and our ability to execute on our Climate Change Strategy. We believe innovative ideas can arise from any level of our organization, so we maintain open channels for submitting ideas. In 2023, we continued to optimize performance by building a foundation of reliable and visible data while we digitized our processes. Our aim going forward is to leverage our data to act on and inform our operational decisions.

Digital Work Environment

Our digitally-enabled workplace supports transparency, collaboration, and data accuracy. Our digital work environment serves as our primary platform for online communication and collaboration. It is the home for our critical work processes and creates a shared and transparent view of operational data to drive decisions. It also provides the structure that empowers our workforce to be agile, efficient, and highly synchronized. The use of this technology has transformed our culture in numerous ways, including:

- Enabling every employee to access a unified, accurate view of critical data.

- Promoting collaboration across business areas and with executives and senior management.

- Driving accountability for data collection and timely reporting.

- Encouraging employees to connect, share ideas, and provide feedback.

- Fostering innovation and capturing ideas that add value.

- Providing insights on areas for improvement.

- Reinforcing data quality to inform goal-setting, strategy, and focus areas.

Our digital work environment is so effective in driving open communication and collaboration that we have been able to successfully transition approximately 64% of our employee workforce to remote work arrangements. For more information about how our remote work arrangements benefit employees and EQT, see Talent Attraction and Retention.

Innovation Process

We are focused on the evolution of our technology to achieve our goals and improve our performance in key indicators associated with material environmental, social, and governance (ESG) topics such as workforce health and safety, operational greenhouse gas (GHG) emissions, economic and societal impacts, and ethics and integrity.

We continue to use our “Innovation Pipeline” process, through which all employees can submit a new idea for consideration and adoption into our operating procedures. Once an employee submits the idea through our digital work environment, a member from our Information Technology team receives automatic notification of the submission and schedules a time to review the submission with the requestor. The goal of that meeting is to confirm alignment with our mission, explore benefits to our operations and costs, or develop new business objectives.

“Information Technology Prime,” a function within our Innovation Pipeline, allows well-planned ideas that satisfy certain general guidelines to be implemented within two weeks of approval. We believe our Innovation Pipeline and our digital work environment enable us to efficiently source, evaluate, and implement new projects. Our Innovation Pipeline has enhanced our innovation process and has given our business the tools to develop meaningful ideas and allow us to deliver quick and effective solutions.

Data Innovation

The future of technological innovation — such as artificial intelligence, automation, and a digital work environment — requires extensive, efficient, and accurate data collection. We have developed a “Plan-to-Pay” system and integrated it into our digital work environment to give us a more holistic view of our operations and capital allocation. All our project bids, cost estimates, and other relevant data points are tied to our Master Operations Schedule, enabling us to seamlessly plan and launch projects and accurately track what we spend against our annual budget. When we capture activity and forecast data in real time, we promote collaboration across relevant groups, including Procurement, Operations, and Production. Our Plan-to-Pay system also exemplifies our efforts to automate systems, as our operating teams can plan a project and automatically receive a service provider name that connects to bids and generates a cost forecast. A workforce culture that supports efficient and accurate data collection underpins the successful use of our data technology. We trust our employees to make responsible decisions and promote accountability to keep our operations efficient.

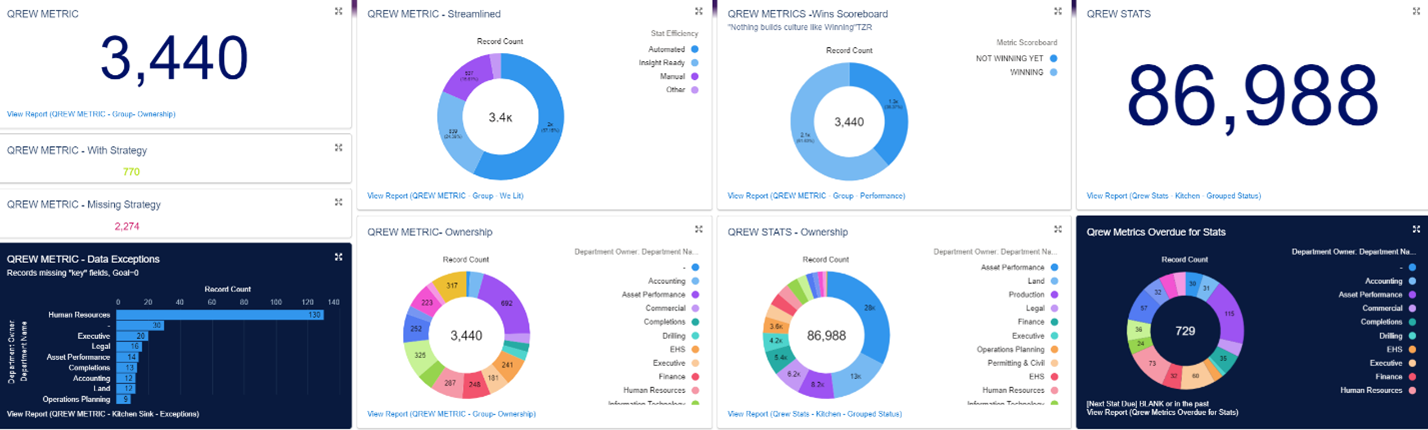

We use a company-wide digital dashboard to track over 3,000 operational and performance metrics and associated statistics, which we refer to internally as our “Qrew Metrics” program. Our Qrew Metrics program is another key element of how we use robust data to track performance across departments and innovate accordingly. Qrew Metrics is a way for us to tabulate, record, track, and prioritize key performance metrics as a company, as departments, and even down to the individual level. Our management teams use Qrew Metric statistics to analyze team functions and determine our strengths and where we can make improvements. For example, we can view how many of our wells are online at any given moment, track safety incidents, and oversee our performance across nearly 400 separate metrics tied to our ESG material topics. Within certain key metrics, we can view the total capital allocated to that metric and how the metric supports overall corporate goals. Each metric takes an element of our mission statement and puts quantifiable numbers to a goal associated with the mission statement. Our Qrew Metrics program has been essential for us to understand and manage our path to achieve our emissions reduction targets. Below is a snapshot of our Qrew Metrics dashboard.

Additionally, to support consistency, transparency, and reliability of our routine processes while affording greater flexibility to our workforce, we have leveraged our digital work environment to develop digital checklists, known internally as “Playbooks,” for many of our routine processes. We use Playbooks throughout our back office and operating departments which allow us to break down a significant process into digestible tasks, referred to as “Contributions,” and can be assigned out at an individual level. Individual Contributions include documented steps needed to complete each task to ensure we capture information consistently and report each instance. Contributions provide an electronic record to assign ownership, collaborate, store related documents, review and approve work, and track key performance statistics that can be leveraged within our Qrew Metrics program.

Since the development of our proprietary Playbooks technology in 2021, we have integrated over 150 different routine business processes into our Playbooks program. These processes include introductory systems, like onboarding employees, to the completion of our routine filings with the U.S. Securities and Exchange Commission, which enables us to quickly generate all Contributions needed to complete the process with the click of a button. This technology greatly improves efficiency, repeatability, and offers greater visibility and dashboard capability to track progress.

[1] Includes gross production from EQT, the Alta Assets and the Tug-XcL Assets. “Gross Production” means the wellhead production of natural gas and oil/condensate produced from all wells operated by EQT, including 100% of volumes from EQT-operated wells subject to a third-party working interest. NGLs are derived from the processing of natural gas and are not directly produced from the wellhead. Therefore, gross production of NGLs is effectively included in the volume of natural gas produced.

[2] Map shows EQT’s core operating area, based on EQT’s fourth quarter 2023 production data, and acreage position as of December 31, 2023.

[3] Throughout this report, we use the following denominations to measure and disclose volumes of natural gas, oil/condensate, and NGLs: MMcf = million cubic feet; Mbbl = thousand barrels of oil/NGLs; Bcfe = billion cubic feet of natural gas equivalent, with one barrel of NGLs and/or crude oil being equivalent to 6,000 cubic feet of natural gas; MBOE = thousand barrels of oil equivalent. A conversion rate of 6 MMcf to 1 MBOE is used to convert MMcf to MBOE.

[4] “Gross Production” means the wellhead production of natural gas and oil/condensate produced from all wells operated by EQT, including 100% of volumes from EQT-operated wells subject to a third-party working interest. NGLs are derived from the processing of natural gas and are not directly produced from the wellhead. Therefore, gross production of NGLs is effectively included in the volume of natural gas produced.

[5] Production data for the Tug-XcL Assets represents total annual gross production for calendar year 2023 and therefore includes production volumes prior to the closing of EQT’s acquisition of such assets in August 2023.

[6] Based on a 365-day year.

Responsibly Sourced Gas (Differentiated Gas)

We have a longstanding commitment to operating responsibly and producing our natural gas in accordance with high ESG standards. In recent years, new certification programs recognizing the environmental attributes of produced gas, such as methane emissions intensity, have been developed. Certification enables responsible producers like EQT to differentiate their gas in the market based on the operator’s performance with respect to certain environmental and social metrics. One such product, often referred to as “independently certified gas,” “responsibly sourced gas” (RSG), or “differentiated natural gas,” involves certification from an independent third party, which affirms that the gas produced is sourced through responsible procurement practices and meets or exceeds certain graded standards, such as low methane and other GHG emissions, water resource impacts, land use, and other categories.

Beginning in November 2021, we obtained certification for a significant portion of our natural gas production under Equitable Origin’s EO100™ Standard for Responsible Energy Development, which focuses on ESG performance, as well as the MiQ methane standard. Responsible Energy Solutions, an approved independent assessment organization for both the EO100™ and MiQ standards, assessed our performance against those standards at approximately 200 well pads located in Greene and Washington Counties, Pennsylvania. From a production standpoint, a significant portion of the natural gas we produce is derived from wells located in these two counties, which collectively produced approximately 3.6 billion cubic feet per day in 2023. For more information about our impact on local communities, see Economic and Societal Impact.

Equitable Origin certified our produced natural gas against the following five principles of the EO100™ Standard:

- Corporate governance and ethics;

- Social impacts, human rights, and community engagement;

- Indigenous Peoples’ rights;[1]

- Occupational health and safety and fair labor standards; and

- Environmental impacts, biodiversity, and climate change.

For the 2023 certification period (i.e., November 1, 2023, through October 31, 2024), we obtained an “A-” score under the EO100™ Standard, an improvement from our “B+” score during the previous assessment period.[2] From a community perspective, our certified operating area comprises a substantial component of our operations. For example, in 2023, we paid $24,754,000 in taxes in Greene County, Pennsylvania and $10,828,000 in taxes in Washington County, Pennsylvania[3] among other charitable donations to local fire departments, first responders, and community development organizations.

From an environmental perspective, as part of our MiQ recertification, MiQ calculated the methane intensity for our operations covered under the certification program as 0.019% for the 2023 certification period, which is more than 61% lower than our 2020 methane intensity calculated by MiQ in our inaugural certification year. For purposes of our MiQ certification, methane intensity was calculated in accordance with the Natural Gas Sustainability Initiative Protocol and factors total methane emissions, total gross gas production, natural gas composition, and natural gas heating values. Based on our methane intensity of 0.019%, we obtained an “A” rating for the methane intensity component of our MiQ certification (granted to producers with a methane intensity under 0.05%), and an overall rating of “A” for our MiQ recertification for 2023.

We work to comply with the principles of international agreements to which the United States is a signatory, and we are an active participant in voluntary programs that aim to monitor and reduce methane emissions on a global scale. In 2023, we continued our membership with the Oil and Gas Methane Partnership (OGMP) 2.0 — a Climate and Clean Air Coalition initiative led by the United Nations Environment Programme in partnership with the European Commission, the United Kingdom Government, the Environmental Defense Fund, and other leading oil and natural gas companies. In 2023, for the second year in a row, we received an OGMP 2.0 “Gold Standard” rating, the highest reporting level under the initiative, in recognition of our ambitious methane emissions reduction targets and advanced commitment to accurately measure, report, and reduce our company-specific and site-level methane emissions. We believe that our certifications from Equitable Origin and MiQ, coupled with our participation in initiatives like OGMP 2.0, will enable us to further differentiate ourselves and our natural gas as a leader in sustainable development and emissions reduction.

We expect a global differentiated gas market to evolve toward a carbon intensity data exchange where all commercial transactions include measurement-informed GHG emissions data. Including third-party certified environmental attributes from the entire natural gas distribution lifecycle will allow energy buyers to make decisions based on a fuel's empirically informed GHG emissions impact. Recognizing that many of our customers are increasingly obligated to cap their emissions and/or purchase GHG emissions allowances, integrating measurement-informed differentiated natural gas with performance certificates presents an opportunity for buyers to reduce their emissions impact. Further, in connection with our partnership with Context Labs, we are building a digital framework that will allow us to demonstrate the environmental attributes of our produced gas for any emissions control or similar framework within the differentiated gas marketplace. We believe that mandatory emissions control programs worldwide will increasingly recognize both fugitive methane emissions and full fuel lifecycle emissions. These trends are anticipated to benefit EQT given our relative emissions performance compared to industry metrics, as well as the fact that we have a robust portfolio of differentiated gas products.

[1] Indigenous Peoples' rights were determined to not be applicable to our covered operations by Equitable Origin under the EO100™ Standard.

[2] See our complete recertification report here: https://energystandards.org/wp-content/uploads/2023/12/EO100-Certification-Summary-EQT-Corporation_Greene-and-Washington-Counties-Pennsylvania_2023.pdf.

[3] Greene County and Washington County tax amounts include a Pennsylvania Impact fee, which is paid to the Pennsylvania Public Utility Commission and then distributed by the Pennsylvania Public Utility Commission to the respective county. The amount of the Pennsylvania Impact fee is directly related to the location of the wells to which the fee applies.