Accelerating the Lower‑Carbon Transition

The Beliefs that Drive Us

We recognize the risks and opportunities that climate change poses to our business and have developed a strategy for how we can best address both transition and physical risks. This strategy is underpinned by our values; represents the short-, medium-, and long-term opportunities for our organization; and is built on three foundational beliefs, detailed below.

Belief 1: Natural gas is critical to accelerating a sustainable pathway to a lower-carbon future and achieving global climate goals.

Natural gas is a critical commodity to facilitate the growth of renewables as part of our power supply, domestically and internationally. Among sources of continuous and reliable power, natural gas leads in its combination of accessibility, lower environmental impact, and exportability. As the United States develops the technology necessary to scale renewable power, the volatility of demand within the power sector on non-renewable power will only increase — and natural gas serves as a necessary fuel source to fill the gaps caused by demand. Through 2050, the long-term outlook from the U.S. EIA is that petroleum and natural gas will remain the most consumed source of energy in the United States as renewables continue to be added to the grid.[1] Furthermore, rapid replacement of coal-fired power generation with natural gas-fired power generation around the world represents the most accessible and significant step to meaningfully accelerate our pathway to global decarbonization.

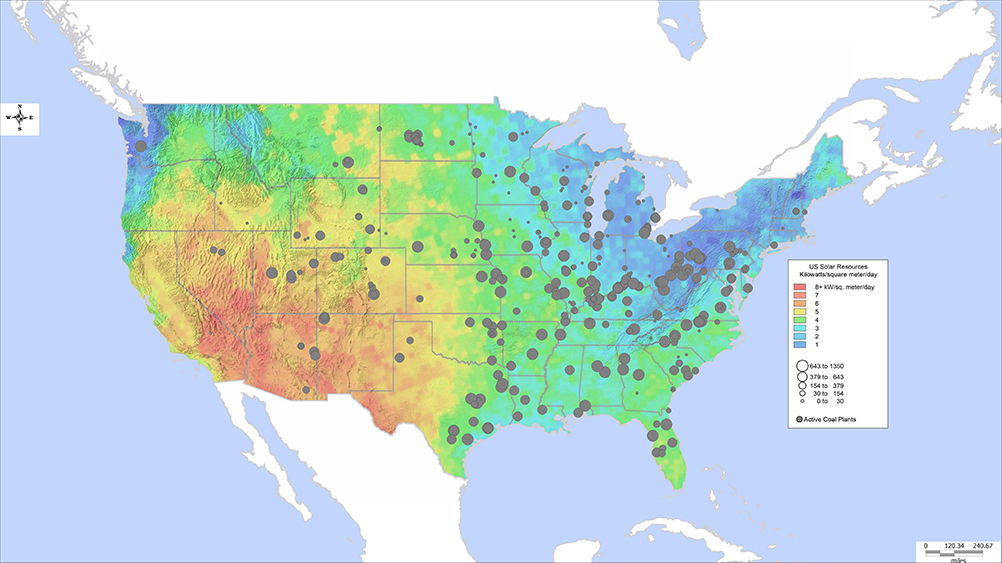

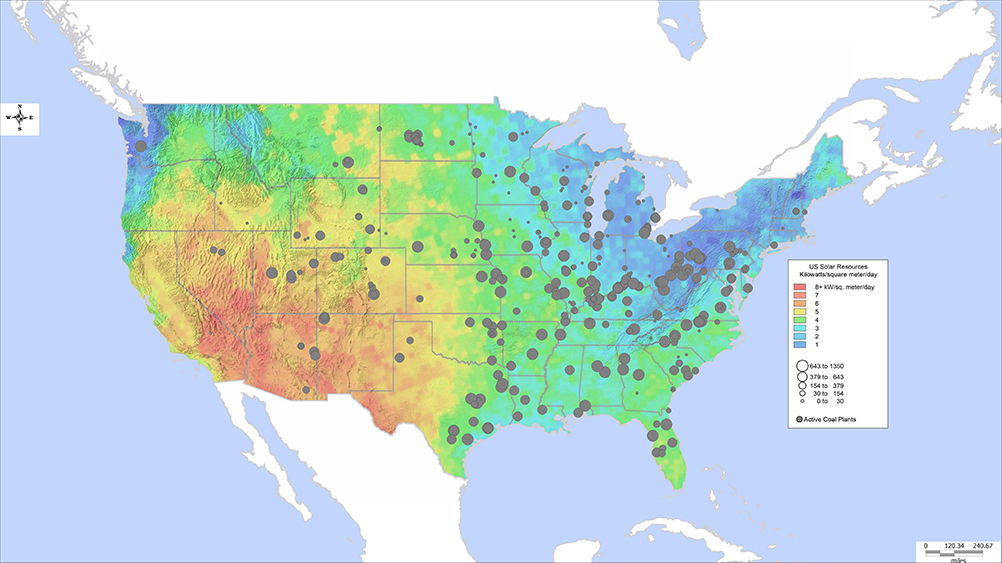

Domestically, renewable energy rapidly increases its impact on energy production. The benefits of increased renewable energy sources can be seen through the reduction in the electricity production share held by coal, which is the highest GHG-intensive component of the U.S. electricity generation mix. However, the ability and pace at which the United States can replace coal-fired power generation with renewables will be challenged in areas where replacement is most needed, due to their low renewable power potential.

U.S. Solar and Coal Resource Availability[2]

Outside of the United States, much of the world still has an energy mix roughly equivalent to that of the United States in 2005. Total global energy-related CO2 emissions reached a new all-time-high in 2023, with reports indicating that coal accounted for more than 65% of that increase.[3] As natural gas has played the leading role in emissions reduction seen within the United States, so too should it play that role at the international level today.

Even if the United States achieved net-zero emissions today, the world would still be on a trajectory to miss its climate goals, in large part because of the significant global consumption of coal. As the largest producer of natural gas in the world,[4] the United States must accept its responsibility to provide natural gas to coal-reliant countries to assist them with their necessary carbon reduction efforts.

Belief 2: Natural gas — particularly Appalachian natural gas — will differentiate itself from other hydrocarbons as the optimal source for reliable, affordable, and responsibly sourced energy.

As the debate about the energy future plays out, we believe greater differentiation will occur between hydrocarbons and producers of hydrocarbons. We also believe there will be greater differentiation between natural gas-focused and oil-focused companies. While the production methods are similar, the consumption of oil-based products and the relevant pathways to decarbonize effectively differ compared to natural-gas based products.

Much like how we see natural gas different from oil and coal, we also see specific natural gas sources different from others. Production of domestic natural gas — particularly natural gas produced in Appalachia, such as in the Marcellus and Utica basin — has emissions intensities lower than other domestic and foreign supply sources.[5] As a result, natural gas companies, particularly those operating in Appalachia, have a meaningful cost advantage for achieving net-zero emissions.

As principal end use differs between natural gas (power) and oil (transportation), the trajectories and cost-benefit analysis of natural gas and oil differ as well. Moreover, the primary pathways to accelerating the lower-carbon transition of one product’s end use (transportation) are through increased usage of the other’s (power for vehicle electrification and hydrogen-based transportation). As such, we believe that as the energy transition debate evolves and the focus on potential solutions shifts from supply to consumption, the traditional grouping of oil and natural gas companies will diverge.

Belief 3: U.S. natural gas has the unique potential to be the largest green initiative on the planet.

Since 2005, the United States has become a world leader in emissions reductions, predominantly through the implementation of gas-fired power in place of coal-fired power generation. Between 2010 and 2023, the United States reduced its carbon emissions by nearly 900 million MT[6] with coal-to-gas substitution as a significant portion of U.S. emissions reductions.

Despite the United States’ efforts, global coal consumption climbed to a new, all-time high in 2024, according to the International Energy Agency (IEA). Two countries, China and India, account for the majority of global coal consumption, with China alone accounting for more than 50% of global coal demand.[7]

Natural gas power generation has unique attributes that make it an optimal alternative to coal power generation, including the following:

- Natural gas power plants provide baseload energy, which complements intermittent energy sources like wind and solar;

- Natural gas plants run more efficiently than coal plants (approximately one natural gas plant can replace two coal plants);[8]

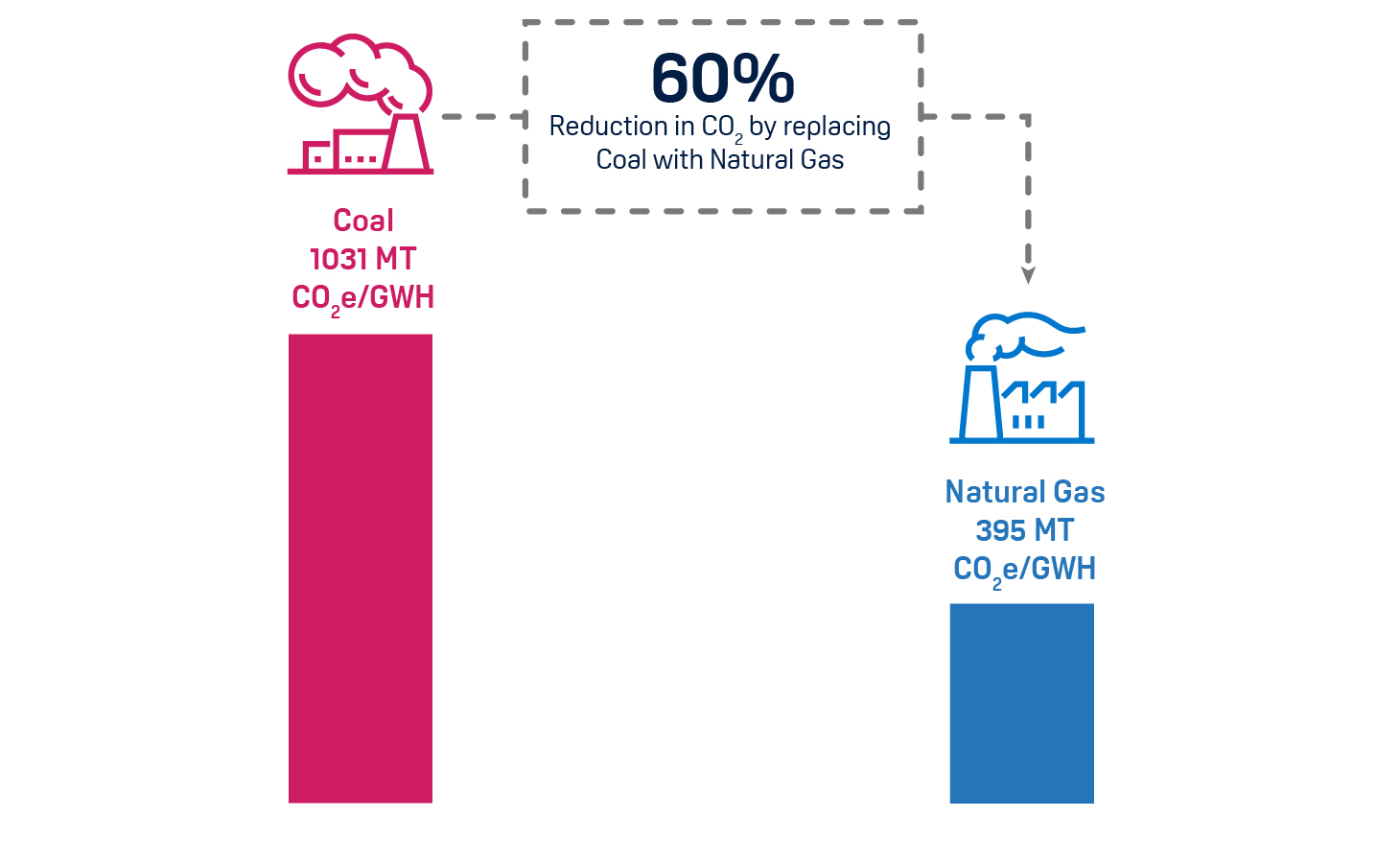

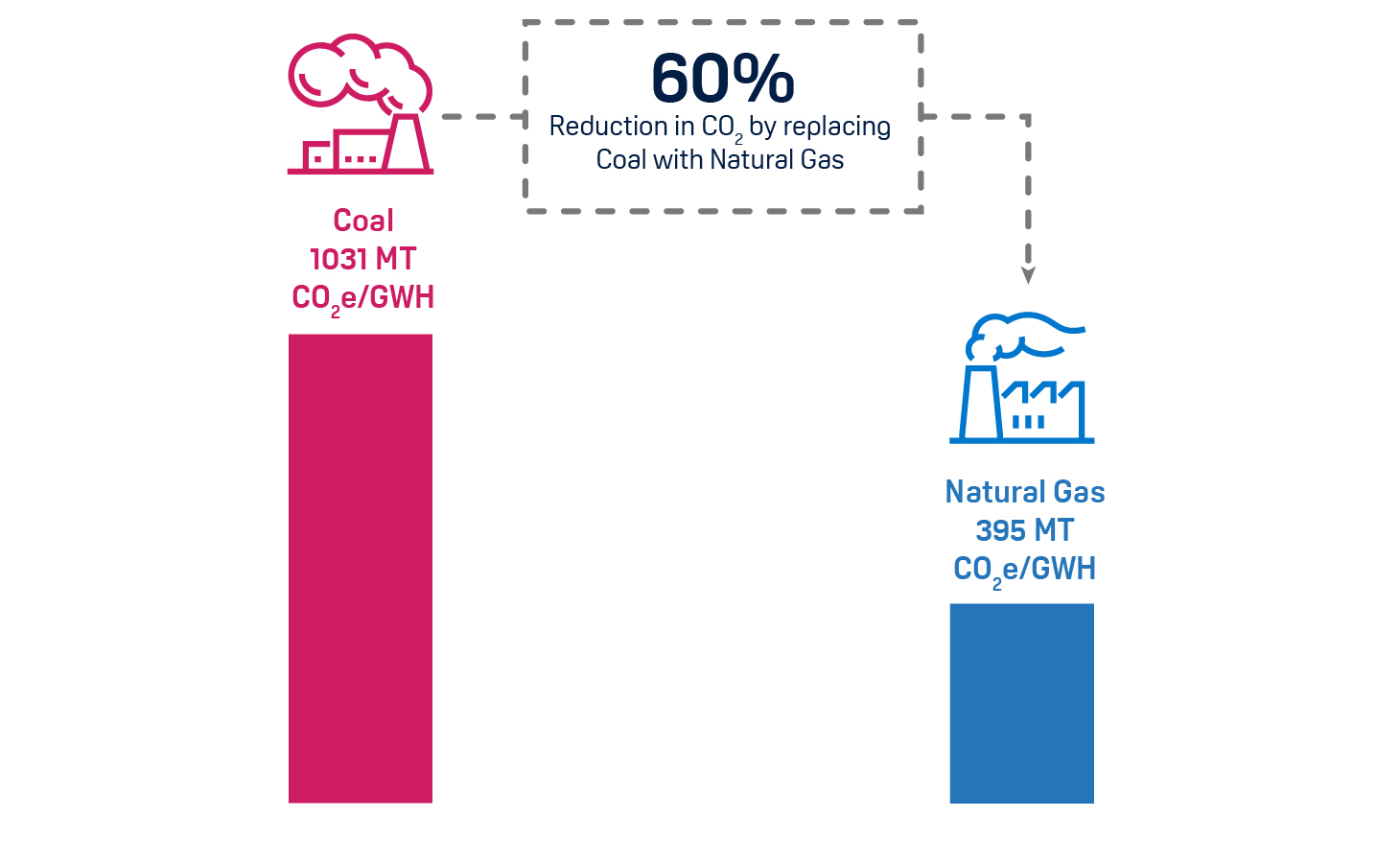

- Natural gas emits 60% less carbon than a comparable amount of coal;[9]

- Natural gas has a lower emissions intensity compared to oil and coal; and

- Natural gas is relatively affordable compared to other fossil fuels and renewable sources.

We believe that the replacement of international coal with U.S. natural gas should be our primary focus in global emissions reduction. If we were to quadruple U.S. liquefied natural gas (LNG) capacity to 55 billion cubic feet of natural gas (Bcf) per day[10] by 2030, we believe we could reduce international carbon emissions by an incremental 1.1 billion MT per year — a 60% reduction in global carbon emissions.

The emissions reduction impact of an unleashed U.S. LNG scenario would have a combined effect equal to the following:

- Electrifying every U.S. passenger vehicle;

- Powering every home in America with rooftop solar and backup battery packs; and

- Adding 54,000 industrial-scale windmills, doubling U.S. wind capacity.

Coal to Natural Gas Switching

Additionally, as U.S. LNG is unleashed from the basin, U.S. citizens that own land resources with natural gas production capacity would be paid for this initiative in the form of tax revenues and annual royalties.