Topic Highlights

Our business success is rooted in robust corporate governance driven by our Board of Directors (Board), which oversees the management of our business with a focus on policy, oversight, and strategic direction.

- Female directors composed half of our Board and served in key leadership positions, including serving as chair of our Board and leadership roles in two standing Board Committees.

- We earned “AA” MSCI environmental, social, and governance (ESG) rating in 2024.

- 20% of our 2024 short-term incentive compensation plan was linked to environmental, health, and safety (EHS) performance.

- Over 400 Environmental, Social, and Governance (ESG) metrics were monitored within our digital ecosystem, enabling us to continue enhancing our performance.

Our Governance Structure

Our Board is the highest governing body at EQT, overseeing the management of our business with a focus on policy, oversight, and strategic direction. To reinforce accountability to our shareholders, all Board directors stand for annual election. We have only one class of voting stock.

Additionally, our Board operates under our comprehensive Corporate Governance Guidelines, which require, among other things, that a majority of our directors be independent and that an independent director be annually appointed to serve as our Board Chair. The leadership responsibilities of our independent Board Chair are outlined in paragraph 5(g) of our Corporate Governance Guidelines.

The Board maintains four standing committees:

- Audit Committee;

- Corporate Governance Committee;

- Management Development and Compensation Committee (Compensation Committee); and

- Public Policy and Corporate Responsibility (PPCR) Committee.

The responsibilities of each standing Board Committee are set forth in a written charter that is publicly available on our Governance Documents page. Both the Corporate Governance Committee and our full Board review the Committee Charters annually. Additionally, our Board may form new committees, disband existing committees, and delegate responsibilities to a committee as necessary.

In alignment with our core values, our Board values diversity and recognizes that a variety of viewpoints enhances dialogue and contributes to more effective decision-making. As of December 31, 2024, female directors represented half of our Board and served in key leadership roles, including Board Chair. Our Board also recognizes the importance of, and benefits from, racial and ethnic diversity. As of December 31, 2024, 14% of our directors were racially or ethnically diverse. Details regarding certain diversity characteristics of our Board are included in the chart below.

EQT Board of Directors Composition and Diversity[1]

Following our 2025 Annual Meeting of Shareholders, the size of our Board decreased from 14 to ten directors, as the result of four of our former directors electing to retire from the Board and not stand for reelection in 2025. Accordingly, as of April 16, 2025, female directors comprise 40% of our Board and 20% of our directors are racially/ethnically diverse.

The decision to move to a smaller Board reflects a strategic approach to enhance decision-making efficiency and streamline governance. However, it also requires careful consideration to ensure different perspectives and expertise are maintained.

As our Board continues to evolve, racial and ethnic diversity will remain an important factor in evaluating the Board’s overall mix of skills, experience, background, and characteristics. More information about our Board can be found on our Board of Directors webpage.

[1] The composition is as of December 31, 2024. Minority population includes American Indian/Alaska Native, Asian, Black/African American, Hispanic, or Latino or any director disclosing two or more races.

ESG Oversight

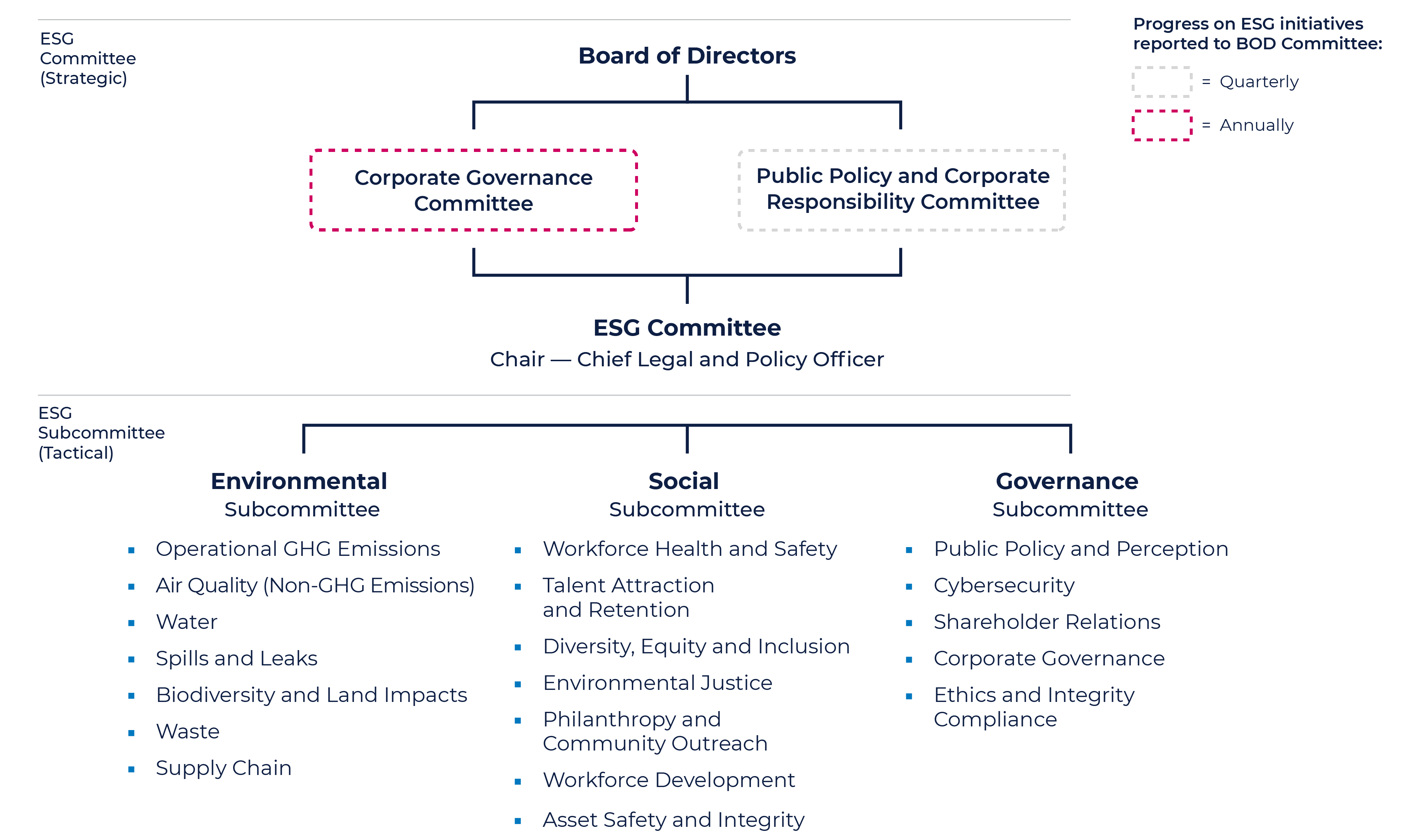

EQT ESG Governance Structure

GHG: Greenhouse gas

Two Board-level Committees — the Corporate Governance Committee and the PPCR Committee — are responsible for the evaluation and oversight, guidance, and perspective of our ESG strategy. Each of these Committees meets at least quarterly and has explicit ESG oversight responsibilities embedded within their formal committee charters.

Our management-level ESG Committee helps guide the execution of our ESG strategy with oversight support from the Corporate Governance and PPCR Committees of the Board. At the beginning of 2025, we refreshed the membership of the ESG Committee to include an expanded group of senior leaders from across the organization. The ESG Committee continues to be chaired by our Chief Legal and Policy Officer. We also established new cross-functional subcommittees to monitor, implement, and recommend appropriate environmental, social, and governance initiatives for review and approval by our ESG Committee. The ESG Committee reports and makes recommendations regularly to both the Corporate Governance and PPCR Committees on current ESG matters. Our full Board also discusses critical ESG topics such as safety, sustainability, climate change, and other environmental matters during the five regular Board meetings each year.

Compensation

Executives and employees participate in our Short-Term Incentive Plan (STIP), an annual cash incentive compensation program, and executives also participate in our Long-Term Incentive Plan (LTIP), a long-term equity incentive compensation program. LTIP awards include Incentive Performance Share Units issued under our Incentive Performance Share Unit Program (IPSUP) and Restricted Share Units. The STIP incentive compensation opportunity is based on the achievement of specific financial, operational, and EHS performance goals, which are reviewed and set annually by the Compensation Committee of our Board. The IPSUP compensation opportunity is typically linked to our total shareholder return performance, evaluated based on a matrix of both absolute and relative total shareholder return performance. The Compensation Committee of our Board defines the performance metrics for both the STIP and IPSUP annually and reviews our performance against these metrics before certifying compensation payouts for the applicable year.

For 2024, 20% of our STIP funding was linked to ESG-focused measures — specifically EHS performance.

The Compensation Committee prioritizes environmentally responsible operations and carbon offset generation to support our net-zero goal by tying a portion of executive and senior management compensation to environmental performance — maintaining accountability for our emissions targets. In 2022, the Compensation Committee incorporated our 2025 net-zero goal into the IPSUP[1] by introducing a new performance payout modifier. This modifier links a meaningful portion of participant payout opportunities to both (i) achieving net-zero greenhouse gas (GHG) emissions by or before our 2025 goal and (ii) how net zero is achieved. This payout modifier was intended to reduce incentive compensation if our net-zero goal was either not achieved by 2025 or if it was achieved through purchasing carbon credits beyond a threshold set by the Compensation Committee. In 2024, we successfully achieved our 2025 net-zero goal pursuant to the parameters set forth in the 2022 IPSUP. The carbon offsets generated and applied to help us achieve our net-zero goal resulted in a total direct incremental cost to EQT that was less than the maximum allowable cost established under the 2022 IPSUP, resulting in a performance payout incentive modifier of 1.1x which, when multiplied by the preliminary 2022 IPSUP payout factor of 1.96x, resulted in a payout multiple for the 2022 IPSUP of 2.15x. For more information on our STIP and IPSUP, and the related performance metrics, see our 2025 Proxy Statement.

ESG Strategy Development and Implementation

Our ESG Committee uses external research, benchmarking, and stakeholder engagement to evaluate ESG data trends and identify the key issues and opportunities for improvement that are most pertinent to us and our stakeholders. Examples include outreach to investors, credit providers, landowners, environmental certification organizations, nongovernmental organizations, and other groups to better understand how we can address key ESG issues. Every 3 years, we also conduct a strategic materiality assessment to ensure our ESG disclosures, initiatives, and strategy align with both internal and external stakeholder expectations. We plan to refresh our materiality assessment in 2025. For more information on our overall stakeholder engagement strategy, see Stakeholder Engagement. Details on our materiality approach can be found in our Global Reporting Initiative (GRI) Content Index, specifically GRI 3-1 and 3-2.

Our ESG Committee also helps our executive team and senior management develop, implement, and monitor initiatives, policies, and disclosures in accordance with our ESG strategy. Along with our Board and Committee oversight, the ESG Committee provides strategic direction to the Board and works with senior management and specific business departments to coordinate effective execution of our ESG strategy across the company.

ESG Reporting

Our ESG Committee oversees our ESG reporting process, including coordination with internal subject matter experts (SMEs) as needed. In addition, our Board and Chief Executive Officer have an opportunity to review and provide feedback on our annual ESG Report.

[1] Our IPSUP compensation plans are based on a 3-year performance period and potential payouts under each IPSUP are assessed at the end of the applicable performance period. For example, the 2022 IPSUP performance period extends from 2022 through 2024. Because our net-zero goal was established as a milestone to be achieved by 2025, meaning that performance against this objective will be measured as of year-end 2024, the Compensation Committee determined that it would not be appropriate to include a payout modifier for achievement of our net-zero goal beyond the 2022 IPSUP.